basic tips

xrp cryptocurrency

Xrp cryptocurrency

By using XRP for cross border payments, financial institutions can bridge currencies and ensure payments are sent and received in local currency on either side of a transaction in as little as 3 seconds.< https://funanimaux.com/ /p>

Unlike proof-of-work or proof-of-stake blockchains, the XRPL uses a consensus protocol, in which servers called validators come to an agreement on the order and outcome of XRPL transactions every 3-5 seconds.XRPL’s diverse list of validators helps ensure its long-term health and consensus among different market participants to secure the XRPL. Learn more about how it works at XRPL.org.

Due to its speed and low cost, XRP can be used just like any other cryptocurrency for transferring value from wallet to wallet. However, Ripple is actively pushing for XRP to be used in large-scale implementations, particularly when it comes to cross-border transfers, where XRP is being positioned as an asset that could act as a bridge in transactions that involve different fiat currencies. To this end, Ripple has created a service called On-Demand Liquidity (ODL).

Cryptocurrency r

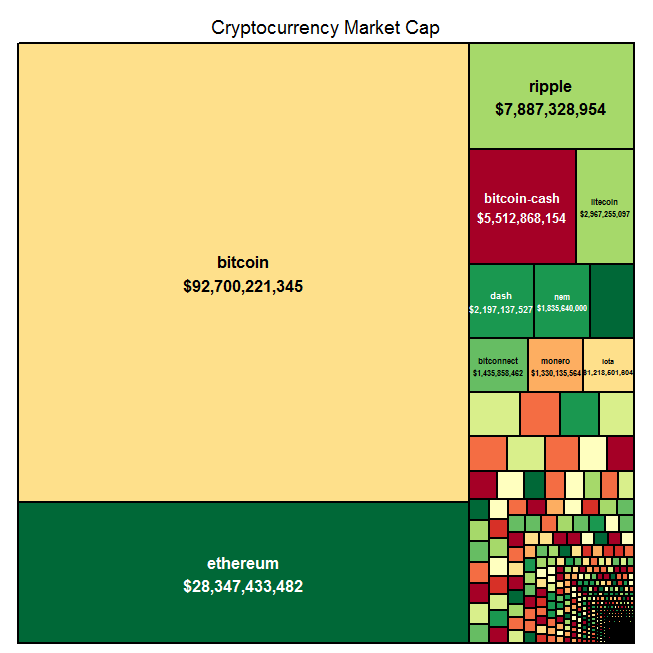

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Retrieves crypto currency information and historical prices as well as information on the exchanges they are listed on. Historical data contains daily open, high, low and close values for all crypto currencies. All data is scraped from < via their 'web-api'.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

MicroStrategy has by far the largest Bitcoin portfolio held by any publicly-traded company. The business analytics platform has adopted Bitcoin as its primary reserve asset, aggressively buying the cryptocurrency through 2021 and 2022. As of August 30, 2022, the company had 129,699 Bitcoin in its reserve, equivalent to just over $2.5 billion.

The -package is a high-level API-client that interacts with public market data endpoints from major cryptocurrency exchanges using the -package. The endpoints, which are publicly accessible and maintained by the exchanges themselves, ensure a consistent and reliable access to high-quality cryptocurrency market data with R.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Bitcoin cryptocurrency

When the cryptocurrency was launched at the beginning of 2009, as Satoshi Nakamoto mined the bitcoin genesis block (the first-ever block on the Bitcoin blockchain), 50 BTC entered circulation at a price of $0.00.

Houd er rekening mee dat een gebruiker een bitcoinwallet kan gebruiken om meerdere nieuwe wallet-adressen te genereren, die elk gepaard zijn aan de unieke persoonlijke sleutel. Deze persoonlijke sleutel blijft constant en moet geheim worden gehouden, terwijl een gekoppeld wallet-adresopenbaar zichtbaar is voor iedereen op de Bitcoin-blockchain.

Scrypt-mining. Deze mining-aanpak is voornamelijk populair op de Litecoin-blockchain. Het is ontworpen als een verbetering op het SHA-256 hash-algoritme. Via Scrypt moeten miners zo snel mogelijk willekeurige getallen genereren en deze op een RAM-locatie opslaan. Deze aanpak is vooral gunstig voor miners met GPU’s en het maakt het voordeel wat ASIC-miners hebben kleiner.

Fifty bitcoin continued to enter circulation every block (created once every 10 minutes) until the first halving event took place in November 2012 (see below). Halvings refer to bitcoin’s issuance system, which was programmed into Bitcoin’s code by Satoshi Nakamoto. It essentially involves automatically halving the number of new BTC entering circulation every 210,000 blocks.

Blockchain analysts estimate that Nakamoto had mined about one million bitcoins before disappearing in 2010 when he handed the network alert key and control of the code repository over to Gavin Andresen. Andresen later became lead developer at the Bitcoin Foundation, an organization founded in September 2012 to promote bitcoin.